Bank Secrecy Act Policy Requirements

The idea of cash laundering is very important to be understood for these working within the financial sector. It's a process by which dirty cash is transformed into clean money. The sources of the cash in actual are prison and the cash is invested in a approach that makes it look like clear money and conceal the identification of the criminal a part of the money earned.

While executing the financial transactions and establishing relationship with the new clients or maintaining existing prospects the responsibility of adopting enough measures lie on every one who is part of the organization. The identification of such ingredient at first is simple to deal with as a substitute realizing and encountering such conditions later on in the transaction stage. The central financial institution in any nation gives full guides to AML and CFT to fight such activities. These polices when adopted and exercised by banks religiously provide sufficient safety to the banks to discourage such conditions.

The BSA requires many financial institutions to create paper trails by keeping records and filing reports on. Financial institutions to assist US.

Overview Of Bsa Aml Ofac Regulations And The Regulatory Bodies

Welcome to the FFIEC Bank Secrecy ActAnti-Money Laundering InfoBase.

Bank secrecy act policy requirements. Bank Secrecy Act Requirements - A Quick Reference Guide for MSBs FinCENgov. The Bank Secrecy Act requires money services businesses to establish anti-money laundering programs that include an independent audit function to test programs In implementing this requirement we determined to make clear that money services businesses are not required to hire a certified public accountant or an outside consultant to conduct a review of their programs. Keep records of cash purchases of negotiable instruments File reports of cash transactions exceeding 10000 daily aggregate amount and.

IBs have been interpreted by FinCEN to fit within the term brokers or dealers in commodities in the financial institution definition and thus also must establish AML Programs. The Bank Secrecy Act BSA 31 USC 5318h requires financial institutions to establish Anti-Money Laundering AML ProgramsFCMs are defined as financial institutions in the BSA. Chapter 4 Bank Secrecy Act The purpose of the Bank Secrecy Act 31 USC 53115332 12 CFR Part 21 is to require US.

Currency Transaction Report. Under the Bank Secrecy ActBSA financial institutions are required to assist US. It specifically requires financial institutions to.

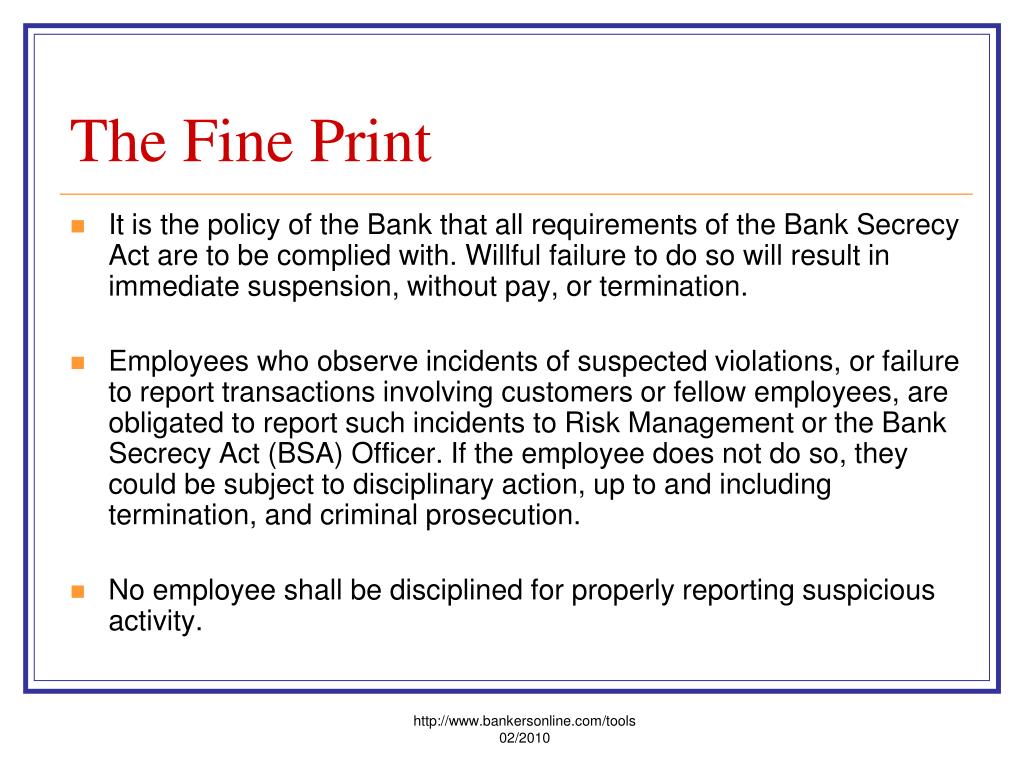

Bank Secrecy Act Policy Be it resolved that this is the policy of to maintain maximum compliance with the Bank Secrecy Act BSA its amendments laws and regulations. Joint Statement on Enforcement of Bank Secrecy ActAnti-Money Laundering Requirements. Legislation aimed toward preventing criminals from using financial institutions to hide or launder money.

Government agencies in detecting and preventing money laundering. Bank Secrecy Act Policy Basic Version. Title 31 revisions include new BSA violations and penalties regarding incomplete or false reports and transactions that involve entities labeled as primary money laundering concerns.

Effective Date 04-10-2020 Wanda R Griffin Director Specialty Examination Policy. Part 3268b1 of the FDIC Rules and Regulations. The Board of Directors designates as the BSA and Office of Foreign Assets Control OFAC Compliance Officer.

A bank must maintain a record of any SAR filed and the original or business record equivalent of any supporting documentation for a period of five years from the date of filing. The Board of Governors of the Federal Reserve System Federal Reserve the Federal Deposit Insurance Corporation FDIC the National Credit Union Administration NCUA and the Office of the Comptroller of the Currency OCC. Regulatory supervision of reporting companies is expected to intensify with the Anti-Money Laundering Act of 2020 AMLA amendment of Title 31 of the Bank Secrecy Act BSA.

Part 3268b1 requires each bank to develop and provide for the continued administration of a program reasonably designed to assure and monitor compliance with recordkeeping and reporting requirements of the Bank Secrecy Act or 31 CFR 103. The Bank Secrecy Act BSA was enacted by Congress in 1970 to fight money laundering and other financial crimes. The purpose of this Bank Secrecy Act Policy Template Basic Version is to address measures used by a bank credit union or other type of financial institution to comply with the requirements of the Bank Secrecy Act.

The intended audience is employees of the Bank Secrecy Act program in the Small BusinessSelf Employed SBSE division and can be referenced by all field compliance personnel. A bank must maintain a record of all Currency Transaction Reports CTR for a. Government agencies in detecting and preventing money laundering such as.

The Bank Secrecy Act BSA is US. Beneficial Ownership Requirements Banks may rely on the person opening the account to certify the identity of the beneficial owners Banks must obtain identities for all legal entity customer accounts For new accounts opened after May 11 2018 For existing accounts when bank management becomes aware of updated information. The FFIEC InfoBase concept was developed by the FFIECs Task Force on Examiner Education and the Task Force on Supervision to provide field examiners at the financial institution regulatory agencies with an electronic source for training and distributing needed examination information.

The law requires financial institutions to provide.

Http Files Hawaii Gov Dcca Dfi Mortgage Loan Originators Bank Secrecy Act Anti Money Laundering Act Policy Pdf

Bank Secrecy Anti Money Laundering Ofac Ppt Video Online Download

Overview Of Bsa Aml Ofac Regulations And The Regulatory Bodies

Ppt Bank Secrecy Act Bsa Powerpoint Presentation Free Download Id 192737

Deterring Financial Crime With The Bank Secrecy Act Watchblog Official Blog Of The U S Government Accountability Office

Overview Of Bsa Aml Ofac Regulations And The Regulatory Bodies

Deterring Financial Crime With The Bank Secrecy Act Watchblog Official Blog Of The U S Government Accountability Office

Bank Secrecy Act Compliance Usps Office Of Inspector General

Anti Money Laundering Program 5 Pillars Of Success

Bank Secrecy Act Anti Money Laundering Examination Manual U S Government Bookstore

![]()

Bank Secrecy Anti Money Laundering Ofac Ppt Video Online Download

Bank Secrecy Act Anti Money Laundering Program Ppt Video Online Download

Bank Secrecy Act 101 Six Things Every Aml Person Needs To Know Acams Today

Overview Of Bsa Aml Ofac Regulations And The Regulatory Bodies

The world of regulations can appear to be a bowl of alphabet soup at times. US money laundering regulations aren't any exception. We now have compiled a list of the top ten cash laundering acronyms and their definitions. TMP Risk is consulting firm centered on protecting monetary companies by lowering risk, fraud and losses. We now have large bank expertise in operational and regulatory threat. We've got a powerful background in program management, regulatory and operational threat as well as Lean Six Sigma and Business Course of Outsourcing.

Thus cash laundering brings many adversarial penalties to the organization due to the risks it presents. It will increase the probability of major dangers and the chance value of the financial institution and in the end causes the financial institution to face losses.

Comments

Post a Comment